The RedBook Insider: 2025’s Brand Value Leaders Revealed: See Which Auto Brands Outpaced the Pack

Discover which automotive brands are leading and lagging in value retention and market sentiment. The 2025 RedBook MEI reveals key trends, top performers, and strategic insights for Australia’s evolving automotive landscape.

The RedBook Insider: Drive Safer with 2025 UCSR Insights

Safety isn't static. Discover how real-world safety ratings and RedBook data help you make smarter choices for fleets, finance, and everyday driving.

The RedBook Insider: RedBook Launches PredictRV Pro, Used Car Price Forecast

RedBook’s PredictRV Pro can forecast daily, monthly, or yearly into the future, using kilometer & condition adjustments.

The RedBook Insider: Emerging Divergence in the Popular 4x4 Ute Segment: Heavy-Duty Performance vs Hybrid-Electric Innovation

Australia’s 4x4 ute segment is diverging; OEMs are going big with diesel workhorses or lean with hybrid-electric newcomers like BYD’s Shark 6. With NVES tightening, retained values and buyer priorities are shifting fast.

The RedBook Insider: Introducing RedBook LIVE: Smarter, Faster, and More Accurate Automotive Intelligence

Using Australia’s largest auto marketplace data, RedBook LIVE delivers daily pricing, trend insights, and VIN-level factory option transparency — helping insurers and industry users benchmark vehicles aga\inst the market with confidence.

The RedBook Insider: Introducing the RedBook Insider Webinar Series

Join our industry experts at the new RedBook Insider webinars to manage RV risk, keep abreast of trends, and optimise your decision-making with trusted data

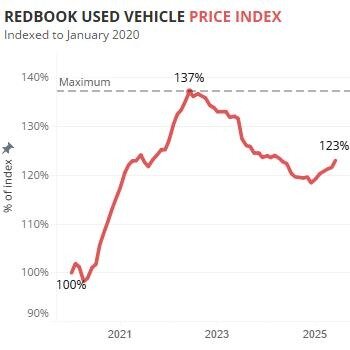

The Redbook Insider: Used Vehicle Price Trends Update

Our June Price Index reveals a split market – resilience for SUVs, softness for premium.

The RedBook Insider: Unlock Factory-Fitted Options with RedBook’s New Tool

Get factory-fitted options and specs straight from the source with RedBook’s new rego-to-VIN lookup, powered by FCAI-authorised data.

The RedBook Insider: NVES Sparks Price Moves and a Pivot to PHEV

It’s only been a month since Australia’s New Vehicle Efficiency Standard (NVES) came into full effect, but the ripples are already starting to show.

The RedBook Insider: Used Vehicle Values Post-COVID: More Than Just a BEV Story

While battery electric vehicles (BEVs) have garnered headlines for rapid depreciation, they’re not the weakest performers.

Recent Posts

-

The RedBook Insider: 2025’s Brand Value Leaders Revealed: See Which Auto Brands Outpaced the Pack17th December 2025

The RedBook Insider: 2025’s Brand Value Leaders Revealed: See Which Auto Brands Outpaced the Pack17th December 2025 -

The RedBook Insider: Drive Safer with 2025 UCSR Insights17th December 2025

The RedBook Insider: Drive Safer with 2025 UCSR Insights17th December 2025 -

The RedBook Insider: RedBook Launches PredictRV Pro, Used Car Price Forecast17th December 2025

The RedBook Insider: RedBook Launches PredictRV Pro, Used Car Price Forecast17th December 2025